How to make millions while doing what you love, according to Sharon Cuneta

Sharon Cuneta offers valuable insights on boosting your finances while pursuing your passions! It's a common aspiration to achieve financial stability and abundance, and gaining wisdom from those who've effectively handled their wealth is invaluable. If you're keen on discovering her advice, keep reading

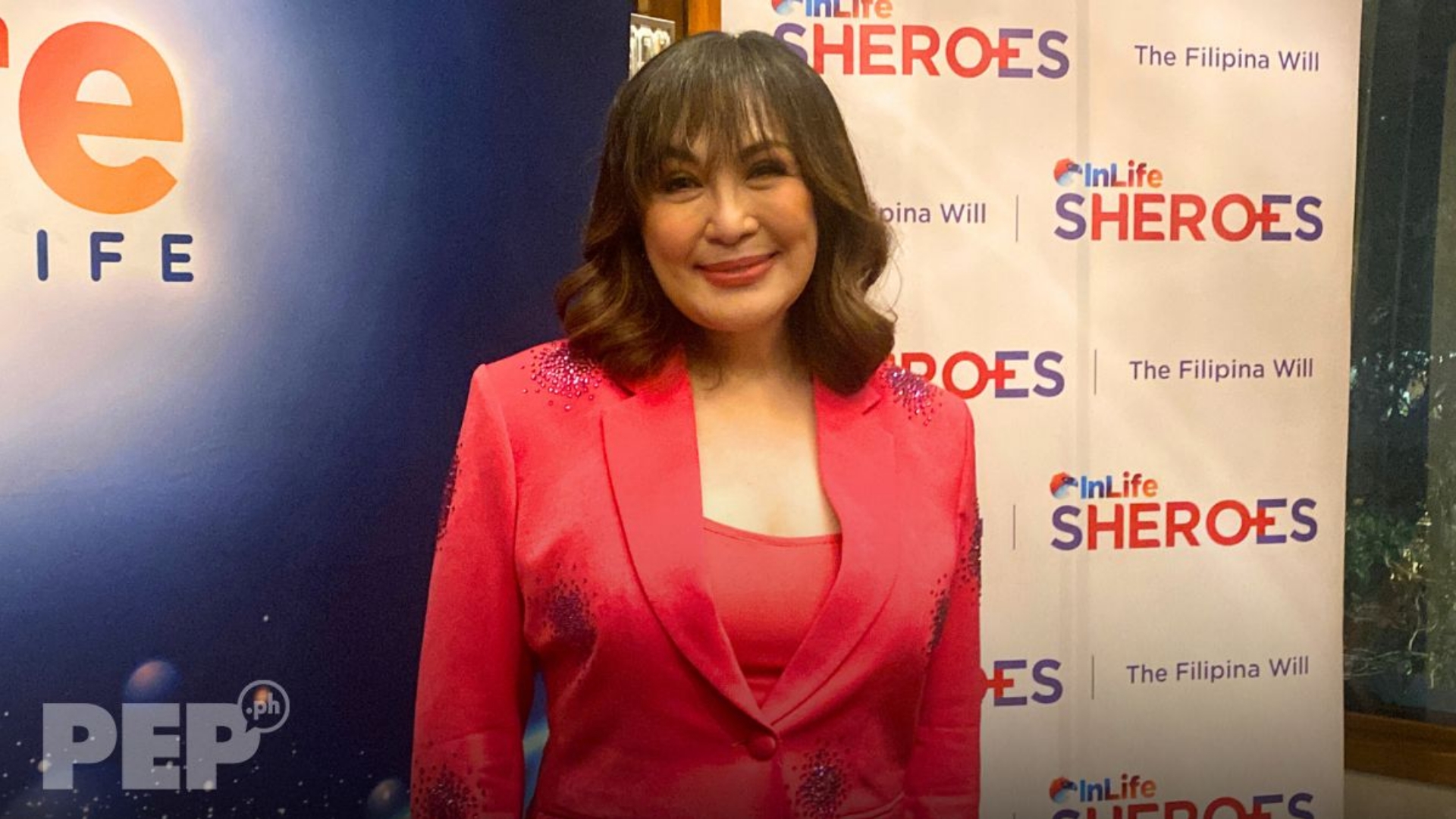

Star actress Sharon Cuneta started her career at the age of twelve and has made a lot of money while focused on staying true to her innocence in her entertainment endeavors.

“Before I start giving advice, I make sure to say that I started singing at 12 and making movies at 15. I made my first million when I was a teenager, and so I’m an exception,” Sharon told reporters during the fifth anniversary celebration of the Sheroes program for women empowerment.

“My father told me that it’s easier to make P10 million from P1 million, than to make your first million. I was in show biz, and so it was faster for me. The thing is, I listened, and so my savings grew and grew,” she added.

Despite her status as an entertainer (singing, acting, hosting, performing in concerts, and producing recordings), Sharon pointed out that her true calling has been in real estate investing. "Thanks to my investments, I was able to grow my show business income, let's say, five to ten times more," she started.

“Let’s say, I buy something for a hundred million. After a few years, I sell it for P400 million. It’s all good because I was just doing what I love and wasn’t really minding it,” she explained. “The important thing to remember is location, location, location. My question to myself before I buy a property is, ‘Would I live in it?’ And if it’s something that’s meant for, let’s say, the middle class, ‘Would they want to live here? Does it have steady water supply? Does the area get flooded?’ All these things that you are afraid of, list them down. It’s that simple. You always make sure you answer these things before you buy something.”

Sharon suggests that novices stay away from stock investing until they have a firm grasp of the idea. She suggests avoiding a broad portfolio and consulting with knowledgeable stock specialists.

Sharon recommends making investments in businesses and in oneself. Don't overinvest; instead, research financial performance. Explore your income-generating options and identify your talents, such as writing or self-publishing. Learning and progress will become easier over time if you share your experiences and use personal struggles as teaching methods.

Life coach Sharon talks about her own heroes, Tony Robbins and Robert Kiyosaki. She suggests against storing money in bank accounts because doing so would enrich the bank. She suggests putting in a lot of effort while striving toward living a fulfilling life. Sharon also suggests spending whatever money that remains after expenses rather than saving it. According to her, having money is a means to an end and ought to be distributed to those who are deserving of assistance.

Speaking about her passion for stewardship, Sharon says she likes to give gifts and assist others. She would rather be wealthy and anonymous than well-known as she can assist without anybody knowing. Sharon discloses her debts, all of which came from her purchases of quality real estate. She eventually sold several properties and built her own home to pay off the loans. Stewardship, in her opinion, is crucial in life.

Never having been conned before, Sharon acknowledges that she was duped by someone she knew, which upset her as she thought the money would have gone toward the project she had planned.