The BIR terminates the deadline for tax clearance in land transfers.

As stated on June 24, the Bureau of Internal Revenue (BIR) has extended the electronic certificate authorizing registration (eCAR) validity period from five years to one year.

“We have removed the five-year validity period for the benefit of taxpayers,” Lumagui stated. “Under Bagong Pilipinas, the BIR will also be a service-oriented agency, not merely a collection-oriented one.”

“Whatever we can do to help ease the burden of our taxpayers in paying their taxes, we will implement,” he added.

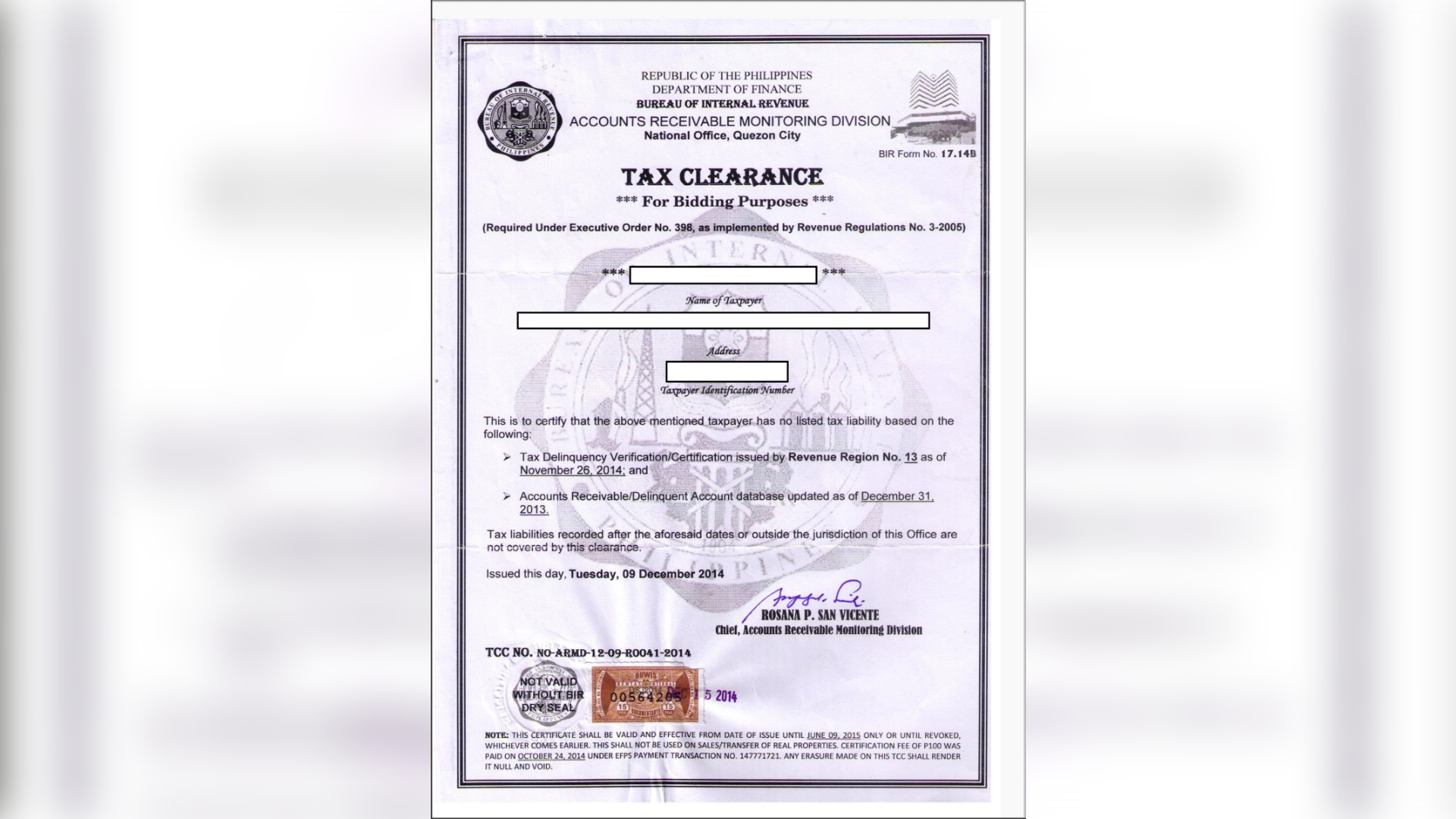

A request to transfer ownership of real estate is made using an electronic copy of the eCAR. It serves as the necessary tax clearance to change the property's title to a different name.

According to Revenue Regulation (RR) No. 12-2024, non-electronic CARs must be revalidated, according to BIR Chief Lumgui. The five-year validity period of the eCARs has ended, therefore taxpayers won't be burdened any longer. The Ease of Paying Taxes Act (EoPT) modifications are regarded as appropriate and evidence of the BIR's dedication to providing top-notch taxpayer assistance.