January Inflation Holds Steady at 2.9%, Driven by Food and Transport, Remains Within BSP Target

According to preliminary statistics released by the Philippine Statistics Authority (PSA), January's headline inflation was stable as a rise in food prices was counterbalanced by lower electricity expenses.

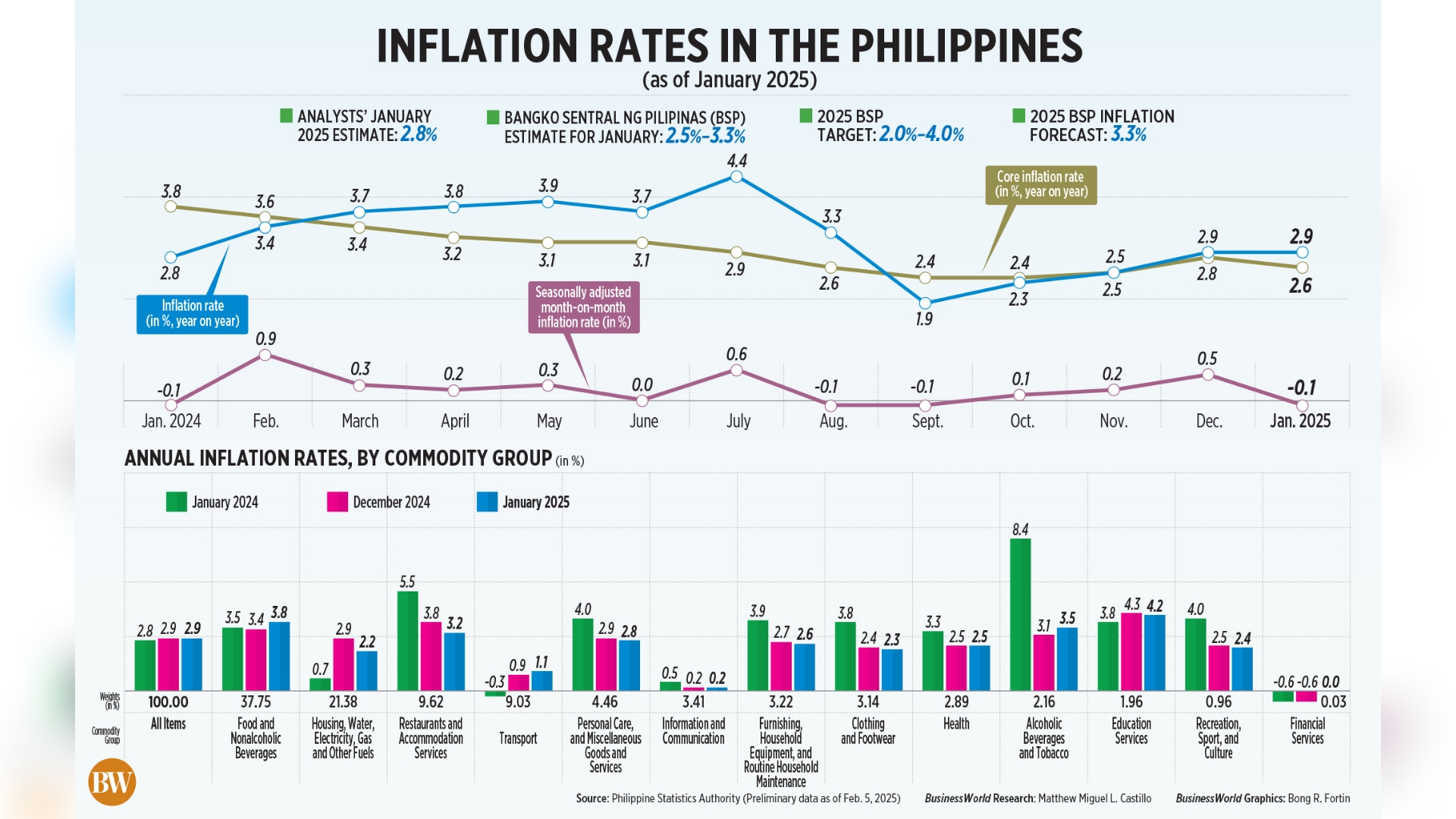

Similar to December, the consumer price index (CPI) increased 2.9% year over year in January. Additionally, it fell within the Bangko Sentral ng Pilipinas (BSP) predicted range of 2.5% to 3.3%.

Additionally, a BusinessWorld survey of 16 analysts found that the January print was somewhat higher than the 2.8% median prediction.

“The latest inflation outturn is consistent with the BSP’s assessment that inflation will remain anchored to the target range over the policy horizon,” the central bank said in a statement.

Food and gasoline prices settled at 2.8% in January, while core inflation in the Philippines stayed at 2.6%. With 50.3% of the total CPI, the food and nonalcoholic beverage index continued to be the largest contributor. Vegetables, tubers, plantains, cooking bananas, and legumes saw increases of 21.1%, while food inflation accelerated to 4%. With an annual increase rate of 155.7%, tomato prices accounted for 12.4% of January's inflation. Meat and butchered land animal costs surged to 6.4%, with higher pig prices resulting from cases of African Swine Fever.

The Philippines' rice inflation rate dropped to 2.3% in January, the lowest since June 2020, when it was -2.8%. For the first time since the -0.1% in December 2021, rice showed a contraction. Even after tariffs were lowered, rice prices remained high, prompting the Agriculture Department to declare a food security emergency. To help bring down the price of the staple grain, the National Food Authority will release buffer inventories at subsidized prices. Inflation was also influenced by the housing, water, electricity, gas, and other fuels index, which decreased from 2.9% in December to 2.2% in January. According to the central bank, disinflation is anticipated to be supported by the drop in rice tariffs and negative base effects, which would likely lead to additional inflation relief in the upcoming months.

Risks to the inflation outlook, however, remain positive, pointing to possible increases in electricity and transportation costs. As one of its top concerns, the government is tackling food inflation by increasing vaccines against ASF and putting actions in place to lessen the effects of La Niña.

At its first policy review next week, the Philippine Central Bank (PSB) is anticipated to lower interest rates by 25 basis points, according to analysts. As long as inflation stays within the lower-bound range of the BSP's 2-4% target band, the BSP is anticipated to keep easing monetary policy in order to strengthen support for domestic demand. The central bank may decide to emphasize growth as a result of the GDP figures being less than anticipated. The fourth quarter saw a slower-than-expected 5.2% growth in the Philippine economy, bringing the full-year 2024 growth to 5.6%.

The BSP will also take the currency into account when making its next policy decision because a lengthier period of unchanged interest rates by the Fed could put pressure on the peso. However, given the economy's significant current account deficit and interest-differential-driven capital outflow, further easing this year is unlikely to be aggressive. Beginning in January 2026, the PSA plans to switch the base year of pricing indices from 2018 to 2023.