Up to 7.5% interest is available on CIMB Bank PH MaxSave Time Deposits annually.

If you haven’t decided where to save this year, CIMB might be the best way to save that money. Aiming to serve at least one million customers in its first year, digital-only commercial lender CIMB Bank Philippines announced on Wednesday that it is now offering time deposits with interest rates as high as 7.5% annually.

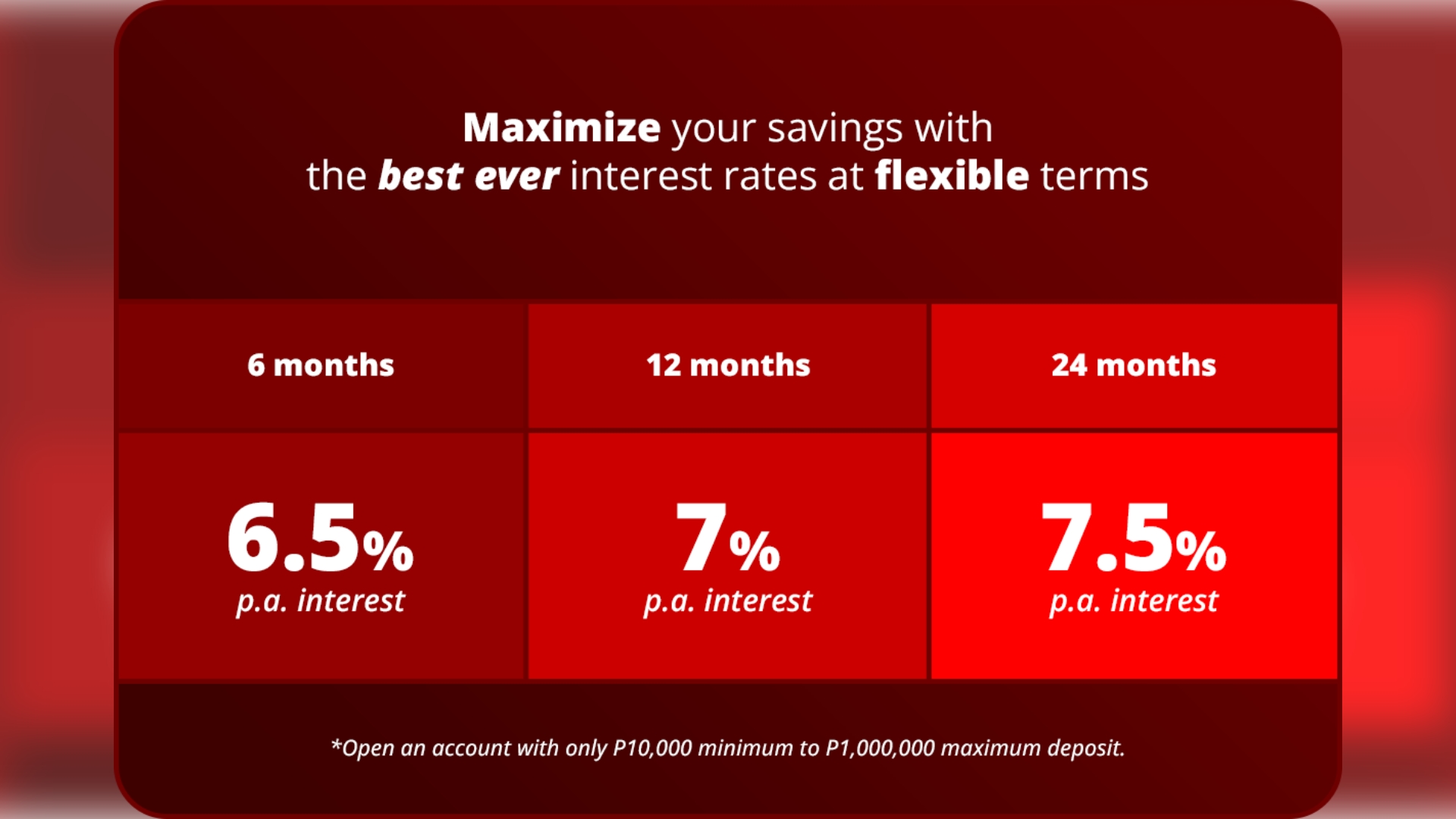

Referred to as the MaxSave Time Deposit, customers can select from three term durations with a P10,000 minimum deposit: six months at 6.5%, twelve months at 7.0%, and twenty-four months at 7.5%.

With the opportunity to open up to five time deposit accounts with a maximum account value of P1 million, the service went live on Wednesday morning.

The product will be covered by the Philippine Deposit Insurance Corp. (PDIC) for up to P500,000 per customer.

“For time deposit, we are targeting to have at least 1 million time deposit customers taking up in the first year, but I think based on projection, in the next three years we expect at least 50% of our customers to take up time deposit,” CIMB Philippines chief business and strategy officer Ankur Sehgal said in a press briefing.

“Since this will be a very high interest rate of 7.5%, we do expect a very high takeup. This is also the highest time deposit (rate) in the market so because of that also, we expect very high takeup in the next coming year,” he added.

The goal of Philippine bank CIMB is to add 10 million customers by 2022, with a 25% yearly increase in deposits and a 40% yearly increase in credit services. Depositors may close their accounts before the end of the term under the bank's MaxSave rules, but they will be responsible for paying the associated fees. Within two days, CIMB will transfer the entire principal amount deposited to the associated savings account, net of interest. The Bangko Sentral ng Pilipinas (BSP) policy rates and market rates, among other things, will be taken into consideration when evaluating the bank's commitment to high interest rates.

Via GMAnews